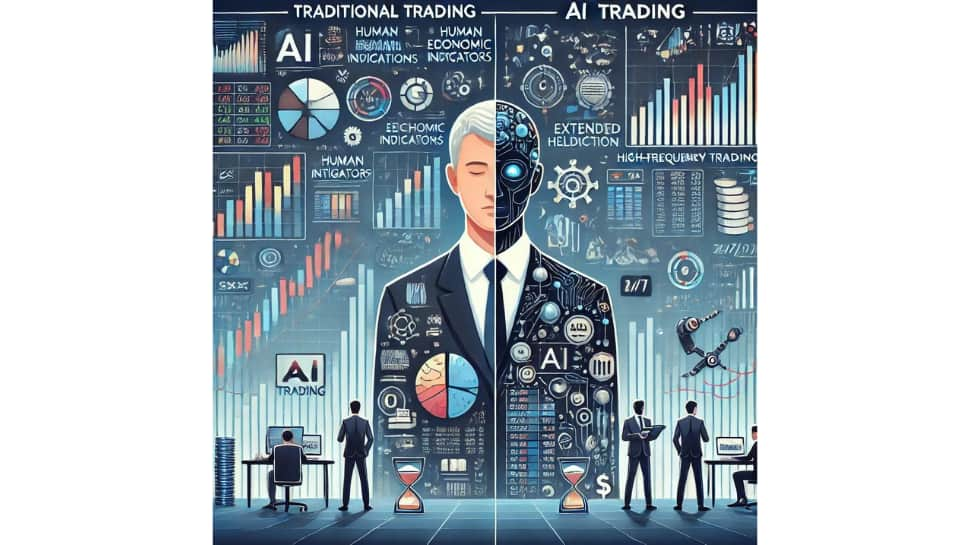

Within the repeatedly evolving panorama of economic markets, the arrival of synthetic intelligence (AI) has profoundly impacted buying and selling practices. Conventional buying and selling strategies, which have been the bedrock of economic markets for many years, are more and more being challenged by AI-driven buying and selling methods.

Conventional Buying and selling: The Previous Guard

Conventional buying and selling, typically known as discretionary or human buying and selling, depends closely on particular person merchants’ experience, instinct, and judgment.

Conventional merchants leverage their expertise, market information, and psychological insights to make buying and selling selections. They analyze charts, financial indicators, and information to foretell market actions, which might be achieved with a foreign currency trading app.

Conventional buying and selling typically entails a mixture of technical evaluation—finding out previous worth actions and patterns—and elementary evaluation, which focuses on evaluating the intrinsic worth of an asset primarily based on financial indicators, firm efficiency, and market situations.

Trades in conventional buying and selling are executed manually by means of brokers or buying and selling platforms. This course of might be time-consuming and topic to human error. Standard buying and selling is commonly related to prolonged holding durations, the place buyers search to profit from prolonged market tendencies and fundamentals reasonably than short-term worth actions.

AI Buying and selling

AI buying and selling represents a paradigm shift in the best way monetary markets function. Leveraging superior algorithms, machine studying, and huge information units, AI buying and selling programs are designed to execute trades with unimaginable velocity, effectivity, and accuracy. Essential options of AI buying and selling embrace:

At its core, AI buying and selling depends on subtle algorithms that may course of huge quantities of information in real-time. These algorithms make use of advanced mathematical fashions to establish buying and selling alternatives and execute trades robotically.

AI buying and selling programs use machine studying methods to analyse historic information, recognise patterns, and predict future market actions. These programs can regularly enhance their efficiency by studying from new information.

Some of the notable purposes of AI buying and selling is high-frequency buying and selling, the place algorithms execute 1000’s of trades per second to capitalise on minute worth discrepancies. HFT corporations leverage velocity and computational energy to achieve an edge out there.

In contrast to conventional buying and selling, AI buying and selling closely depends on information. To make knowledgeable selections, algorithms analyse information sources, from historic worth actions and buying and selling volumes to social media sentiment and information articles. This situation permits AI programs to react swiftly to market modifications that human merchants would possibly miss.

Evaluating the Benefits

Some of the vital benefits of AI buying and selling over conventional buying and selling is its unparalleled velocity and effectivity. AI programs can course of and analyse huge quantities of information inside milliseconds, enabling them to execute trades virtually instantaneously. This provides AI buying and selling a considerable edge in markets the place even microsecond benefits can translate into vital monetary good points. Conventional merchants, then again, are restricted by human cognitive and bodily speeds, making it difficult to compete with AI by way of execution velocity.

Accuracy and Consistency

AI buying and selling programs are designed to comply with predefined guidelines and standards, guaranteeing excessive consistency in buying and selling selections. In contrast to human merchants, who might be influenced by feelings akin to concern and greed, AI algorithms function primarily based on goal information and programmed logic. This minimizes the danger of impulsive selections and will increase the accuracy of trades. Whereas doubtlessly benefiting from human instinct and expertise, conventional buying and selling is commonly topic to emotional biases and inconsistencies.

Skill to Deal with Giant Knowledge Units

AI buying and selling excels in processing and analysing massive datasets, a activity that’s virtually unimaginable for human merchants to perform on the identical velocity and scale. By leveraging large information, AI programs can uncover hidden patterns and correlations that is likely to be missed in conventional evaluation. This capability to synthesise huge quantities of data permits AI buying and selling to establish extra advanced buying and selling alternatives and optimise methods dynamically.

Spherical-the-Clock Operation

AI buying and selling algorithms can function 24/7 with out breaking, enabling steady monitoring and participation in world markets. That is significantly advantageous in a world the place monetary markets are more and more interconnected and function throughout completely different time zones. Constrained by human limitations, conventional merchants can’t preserve fixed vigilance and are thus deprived relating to round the clock buying and selling.

Conventional Buying and selling: The Human Component

Human merchants deliver instinct, expertise, and a qualitative understanding of market dynamics that AI programs lack. The power to interpret nuanced data, such because the potential influence of geopolitical occasions or market sentiment shifts, is a definite benefit of human merchants. This may be significantly invaluable when qualitative insights are important in decision-making.

Flexibility and Adaptability

Conventional merchants can adapt their methods dynamically primarily based on evolving market situations. Whereas AI programs might be programmed to regulate parameters primarily based on particular standards, human merchants can understand and reply to unprecedented occasions or anomalies extra flexibly. This adaptability is very essential throughout market uncertainty or volatility durations, the place inflexible, pre-programmed responses won’t suffice.

AI Buying and selling

AI fashions would possibly change into too finely tuned to historic information, resulting in overfitting. This may end up in fashions that carry out exceptionally properly on previous information however fail to generalize to new, unseen market situations.

Many AI algorithms, particularly these involving deep studying, function as “black bins” the place the decision-making course of isn’t clear. This lack of interpretability could make it tough to belief and validate AI selections, posing vital dangers.

AI buying and selling programs are inclined to technical failures, akin to software program bugs, {hardware} malfunctions, or cyber-attacks, which may lead to substantial monetary losses.

Utilizing AI in buying and selling can elevate regulatory and moral questions, together with market manipulation, equity, and the potential for AI-induced flash crashes. Stringent laws are wanted to make sure the accountable use of AI in monetary markets.

Conventional Buying and selling

Human merchants are vulnerable to emotional biases, akin to overconfidence, panic, and loss aversion, which might negatively influence decision-making and result in inconsistent outcomes.

Human merchants have restricted capability to course of and analyze information, making it tough to compete with AI programs that may deal with huge datasets and sophisticated computations.

Handbook execution of trades is inherently slower than automated execution, leading to potential delays and missed alternatives in fast-moving markets.

The Hybrid Strategy

Because the monetary panorama evolves, a hybrid strategy that integrates the strengths of AI and conventional buying and selling is more and more seen because the optimum technique. This strategy leverages AI’s computational energy and data-processing capabilities whereas retaining human merchants’ qualitative insights and flexibility.

Enhanced Resolution-Making

By combining human instinct with AI-driven information evaluation, merchants could make extra knowledgeable and nuanced selections. For instance, human merchants can use AI to sift by means of huge quantities of information to establish potential buying and selling alternatives, which might be additional scrutinized by means of human judgment. This synergistic strategy enhances decision-making, leading to extra sturdy buying and selling methods.

Continued Studying and Adaptation

AI programs can regularly study from new information and adapt to altering market situations, however they will additionally profit from the oversight and strategic enter of skilled merchants. Human merchants can fine-tune AI fashions and incorporate real-time qualitative insights that algorithms won’t seize. This adaptive studying cycle between people and machines can result in more practical and resilient buying and selling methods.

Additional developments in AI and expertise will doubtless dominate the way forward for buying and selling, however the function of human merchants will stay indispensable.

Quantum Computing

Quantum computing has the potential to revolutionize AI buying and selling by considerably enhancing computational energy and information processing speeds. Quantum algorithms can remedy advanced optimization issues sooner than classical computer systems, offering a considerable edge in markets the place velocity and effectivity are paramount.

The Evolution of Regulatory Frameworks

Regulatory frameworks should evolve as AI and different superior applied sciences proceed to reshape the buying and selling panorama to deal with rising challenges. Regulators worldwide are grappling with the implications of AI-driven buying and selling, striving to make sure market integrity, equity, and transparency.

Hanging a Stability

Regulatory our bodies should steadiness fostering innovation and defending market individuals from potential abuses and systemic dangers. This entails creating tips that enable for the moral use of AI whereas implementing sturdy monitoring and enforcement mechanisms to stop market manipulation and unfair practices.

Conclusion

The comparability between AI and conventional buying and selling reveals a dynamic interaction between revolutionary expertise and human experience. AI buying and selling provides unparalleled velocity, accuracy, and information processing capabilities, making it an indispensable instrument in fashionable monetary markets. Nevertheless, the human aspect stays important, offering instinct, adaptability, and relational abilities that AI can’t absolutely replicate.

A hybrid strategy that leverages the strengths of each AI and conventional buying and selling is rising because the optimum technique for navigating the complexities of at this time’s monetary setting. As AI continues to advance and regulatory frameworks evolve, the way forward for buying and selling will doubtless be characterised by higher collaboration between people and machines, resulting in more practical, clear, and resilient monetary markets.

The mixing of AI in buying and selling isn’t merely a development however a elementary shift reshaping the panorama of worldwide finance. By embracing this transformation thoughtfully and ethically, market individuals can harness the total potential of AI whereas safeguarding the rules of integrity and equity that underpin the monetary business.

(This text is a part of IndiaDotCom Pvt Ltd’s Client Join Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no duty, legal responsibility or claims for any errors or omissions within the content material of the article. The IDPL Editorial crew isn’t chargeable for this content material.)