Ram Ram. The fiscal ledger of presidency expenditures, higher referred to as the funds, has been unveiled. Opposite to expectations, the funds turned out to be extra lackluster than anticipated. The thrill surrounding the funds has diminished following the introduction of GST and the discontinuation of the separate railway funds. Nevertheless, salaried people like us all the time maintain a watch out, particularly since these incomes extra but evading taxes may not even concentrate on the revenue tax slabs. Our anticipation has been ongoing since 2017, an entire seven years. It was then that Arun Jaitley decreased taxes for incomes between 2.5 to five lakh. Since then, the slabs have remained unchanged. Within the 2019 funds, Piyush Goyal elevated the usual deduction to 50,000 and launched a full tax rebate for incomes as much as 5 lakh, which was additionally an interim funds.

Expectations Versus Actuality

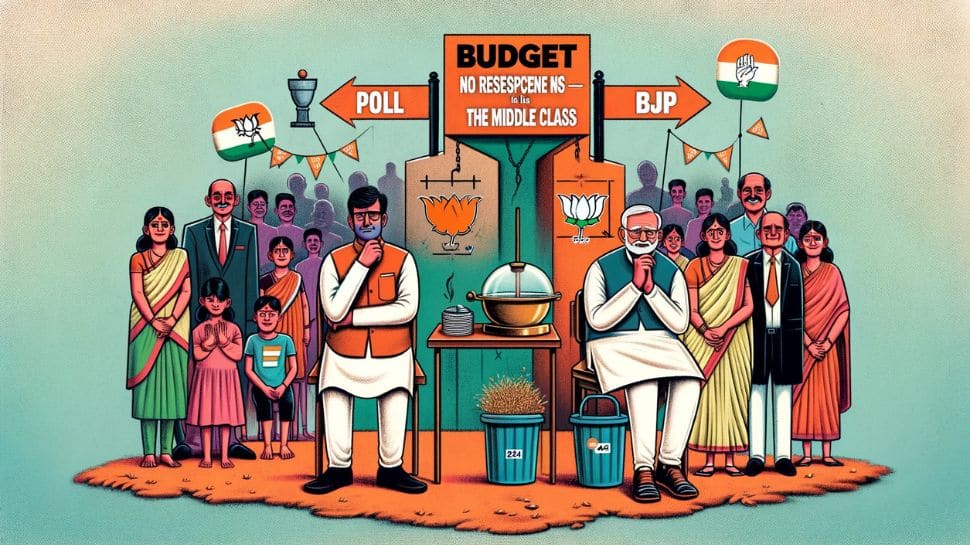

With the Lok Sabha elections on the horizon, expectations have been excessive for this funds, which in the end was disillusionment. PM Modi’s confidence, or reasonably, his belief within the voters, outweighed every thing else. The aspirations of the three.5 crore revenue tax payers appear insignificant compared, with their religion resting solely on Modi. It is a peculiar state of affairs the place the BJP is aware of properly that our disappointment will barely scratch the floor of the electoral mandate.

A Missed Alternative for a Well-liked Finances

Previous to the elections, the federal government might have offered a extra populist funds, particularly with a big alternative to attraction to the center class following the Ram Mandir development. Finance Minister Nirmala Sitharaman might have performed a card within the supplementary funds, as there is not any legislation towards it. This authorities granted a rebate within the 2019 funds, and earlier than that, Chidambaram introduced a number of populist measures within the 2014 supplementary funds. Nevertheless, the Modi authorities selected to not observe this path. Aiming for a 400+ mission, the BJP offered a funds centered on the financial system’s well being. Sitharaman made it clear that direct and oblique tax constructions would stay unchanged.

A Token of Thanks however Little Else

Sitharaman did lengthen a thanks to taxpayers for his or her vital contribution to the nation’s improvement. The federal government has rationalized tax charges, with no legal responsibility for incomes as much as 7 lakh underneath the brand new tax regime.

Nevertheless, past the thanks, there was little to appease the taxpayers. Contemplating the fiscal deficit at 5.eight p.c of the GDP, it is clear the distinction between income and expenditure is huge. The federal government plans to borrow roughly 14 lakh crore rupees subsequent yr to fund welfare schemes and enhance the financial system. PM Modi continues to extend spending on roads, ports, faculties, schools, protection, and manufacturing, that are important for the nation’s improvement. The funds additionally elevated capital expenditure by 11 p.c to over 11 lakh crore rupees.

The Essence of the Finances

Sitharaman summarized the funds’s spirit by stating that “A self-reliant India is shifting in the direction of Amrit Kaal with the collective effort of everybody,” echoing the sentiment of “Jai Jawan, Jai Kisan, Jai Vigyan,” and now specializing in analysis as “Jai Anusandhan.” The funds was crafted with a far-sighted strategy, guaranteeing political stability. The deal with OBCs and caste census by Rahul Gandhi in the course of the Bharat Jodo Yatra was counteracted by Modi’s technique, mirrored within the funds emphasizing that there are solely 4 castes within the nation – the poor, youth, ladies, and farmers. The emphasis on empowering “lakhpati sisters” and specializing in gender budgeting is about to proceed.

With this centered strategy and a Ram-centric ambiance, Modi’s authorities’s confidence has soared to the extent that there was no room left within the funds for minor reliefs for the frequent man.