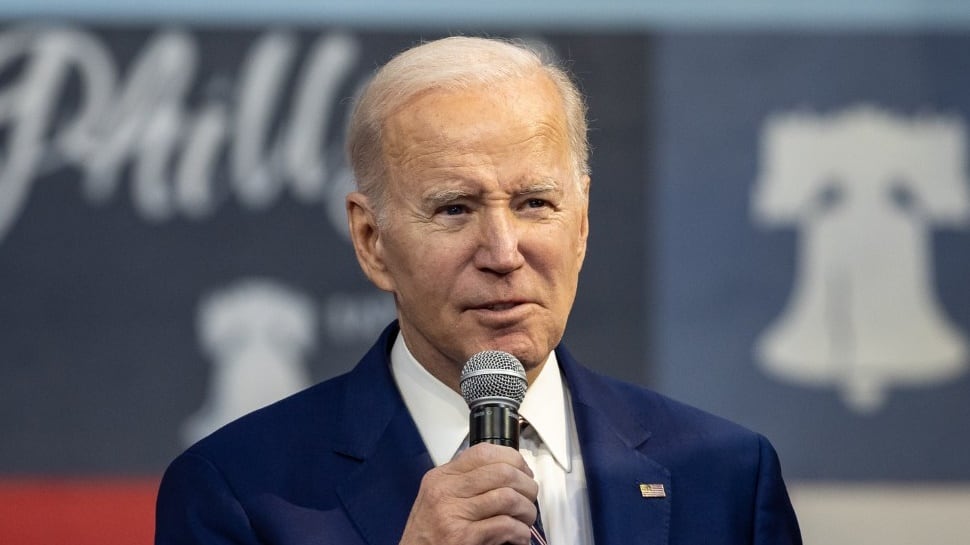

WASHINGTON: Regardless of failing to ship his promise for broad scholar mortgage forgiveness, President Joe Biden has now overseen the cancellation of scholar loans for greater than 5 million Individuals — greater than some other president in US historical past. In a last-minute motion on Monday, the Training Division cancelled loans for 150,000 debtors by way of programmes that existed earlier than Biden took workplace. His administration expanded these programmes and used them to their fullest extent, urgent on with cancellation even after the Supreme Court docket rejected Biden’s plan for a brand new forgiveness coverage.

“My Administration has taken historic motion to cut back the burden of scholar debt, maintain dangerous actors accountable, and combat on behalf of scholars throughout the nation,” Biden stated in a written assertion. In complete, the administration says it has waived USD 183.6 billion in scholar loans. The wave of cancellation may dry up when President-elect Donald Trump takes workplace. Trump hasn’t detailed his scholar mortgage insurance policies however beforehand known as cancellation “vile” and unlawful.

Republicans have fought relentlessly in opposition to Biden’s plans, saying cancellation is finally shouldered by taxpayers who by no means attended faculty or already repaid their loans. Biden loosened guidelines for debt forgiveness The newest spherical of aid principally comes by way of a programme generally known as borrower defence, which permits college students to get their loans cancelled in the event that they’re cheated or misled by their faculties. It was created in 1994 however hardly ever used till a wave of high-profile for-profit faculty scandals in the course of the Obama administration.

A smaller share of the aid got here by way of a programme for debtors with disabilities and thru Public Service Mortgage Forgiveness, which was created in 2007 and gives to erase all remaining debt for debtors in a authorities or nonprofit job who make 10 years of month-to-month funds. Most of Monday’s borrower defence cancellations had been for college kids who attended a number of defunct faculties owned by Middle for Excellence in Increased Training, together with CollegeAmerica, Stevens-Henager Faculty, and Independence College. They’re primarily based on previous findings that the colleges lied to potential college students about their employment prospects and the phrases of personal loans.

Earlier than Biden took workplace, these programmes had been criticised by advocates who stated complicated guidelines made it tough for debtors to get aid. The Biden administration loosened a number of the guidelines utilizing its regulatory energy, a maneuver that expanded eligibility with out going by way of Congress. For example, simply 7,000 debtors had gotten their loans cancelled by way of Public Service Mortgage Forgiveness earlier than the Biden administration took workplace. Widespread confusion about eligibility, together with errors by mortgage servicers, resulted in a 99 per cent rejection price for candidates.

Large numbers of debtors made years of funds solely to search out out they had been in an ineligible reimbursement plan. Some had been improperly put into forbearance — a pause on funds — by their mortgage servicers. These intervals did not find yourself counting towards the 10 years of funds wanted for cancellation. The Biden administration briefly relaxed the eligibility guidelines in the course of the pandemic after which made it extra everlasting in 2023. Consequently, greater than 1 million public servants have now had their balances zeroed out by way of the programme.

All these rule adjustments had been meant to be a companion to Biden’s marquee coverage for scholar debt, which proposed as much as USD 20,000 in aid for greater than 40 million Individuals. However after the Supreme Court docket blocked the transfer, the Biden administration shifted its focus to maximizing aid by way of current mechanisms.

Republicans have known as for a distinct strategy Bulletins of recent cancellation grew to become routine, at the same time as conservatives in Congress accused Biden of overstepping his energy. Republican states fought off Biden’s later makes an attempt at mass forgiveness, however the smaller batches of aid continued with none main authorized problem.

As Republicans grab each chambers of Congress and the White Home, Biden’s adjustments may very well be focused for a rollback. Nevertheless it’s unclear how far the following administration will go to tighten the cancellation spigot. Trump proposed eliminating PSLF throughout his first time period in workplace, however Congress rejected the thought. Challenge 2025, a blueprint created by the Heritage Basis for a second Trump time period, proposes ending PSLF, and narrowing borrower defence and making reimbursement plans much less beneficiant than current ones.